HandyTrain has been built with insights from industry leaders responsible for driving training and productivity of field and retail staff using our LMS solution.

CXOs understand the importance of an engaged workforce. HandyTrain's LMS app saves time and cuts cost, so you can focus on creating winning teams.

HandyTrain is a mobile training solution that enables organisations to train, assess and engage their workforces - empowering them to achieve more.

Yes! HandyTrain is a cloud based LMS hosted on Amazon Web Services (AWS). It is secure, fast, and scalable.

You can have HandyTrain up and running in less than an hour!

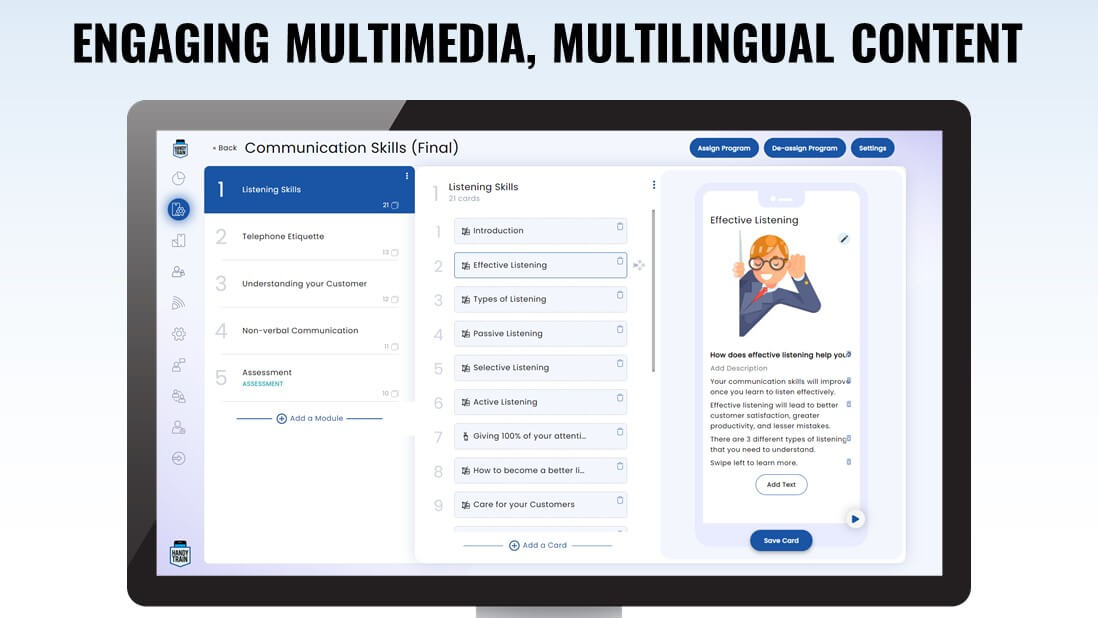

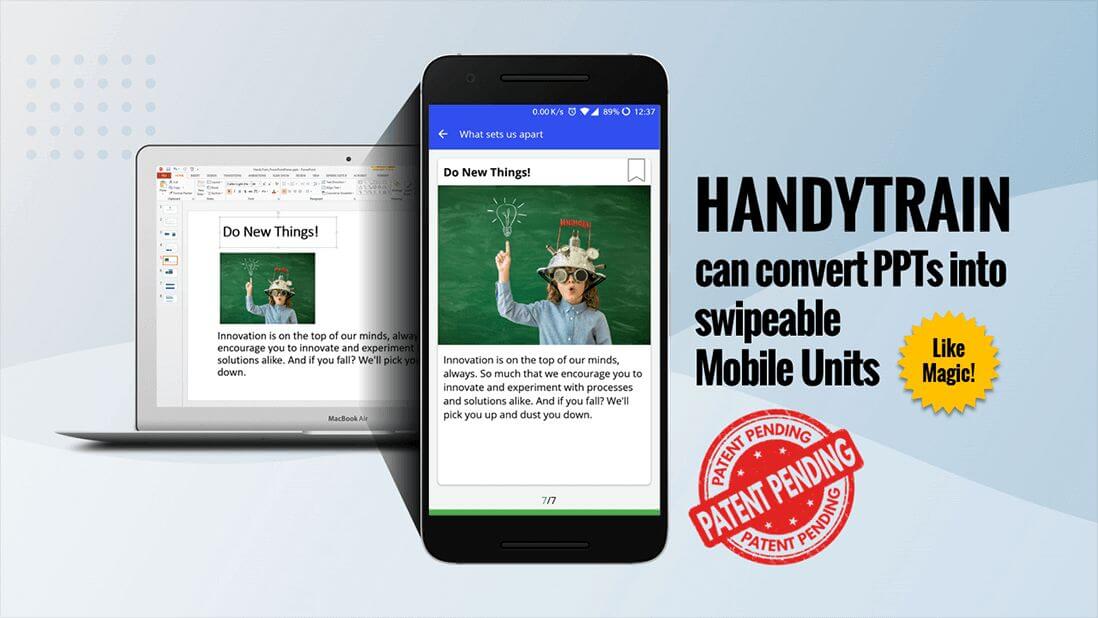

Use our AI engine to transform your presentations and documents into editable cards in a few seconds! Creating your bespoke microlearning content on HandyTrain is as easy as writing an email.

You can also pick, choose and buy from over 1,000 microlearning courses from HandyTrain’s partners.

Yes! HandyTrain supports SCORM

Yes! HandyTrain supports multiple assessment templates with a high degree of configurability for timing, randomization and scheduling.

Absolutely! Reward your learners with badges, and award customized certificates.

HandyTrain’s pricing is based on the number of learners. With flexible pricing you’ll never pay for more than you need.